Trading and getting no joy? You should read this … and get real. But make sure you read Part One first.

QUESTION: Why spend money and take so much effort to learn what is safe when it is not the safe stuff that kills your trade or investment?

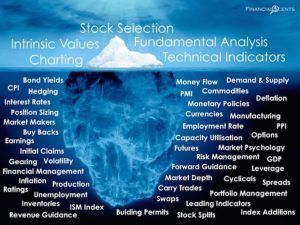

When starting out in the financial markets, the usual and common approach is to learn Technical and Fundamental Analyses. Most traders assume that it will be sufficient enough to get started. Some never venture further and solely depend on technicals only.

This is yet another common misconception as a result of the confusion between Trading and Investing as we discussed in the previous article.

Technicals & Fundamentals are only sufficient and necessary for long-term investing. Trading goes a long way more than just mere technicals or fundamentals. Truth is, fundamentals seldom matter to the short-term trader while technicals matter little to the long-term investor.

In fact, there have been countless debates about the merits of Fundamental Analysis versus Technical Analysis.

In actuality, it is not even a debate. Fundamentals, at best, is manipulated through creative accounting and speculative projections while Technicals are always lagging because they require a series of closing prices that don’t tell you the future. But the reason it is not even a debate is that these two elements only account for less than 15% of the risk, in the opinion of this Global Macro Pattern Trader.

The other reason that Technicals vs Fundamentals is not a debate is because this stuff is safe. And it is never what’s safe that compromises the trade – it is the unseen danger that Technicals and Fundamentals don’t reveal.

FACT: Danger always lurks where you can’t see it.

A mundane looking terrain might look peaceful and safe to a soldier who doesn’t know that there are landmines and booby-traps below the surface. Waterpolo looks like fun until you get into the water to get scratched, punched and kicked below the water line out of the referee’s view.

A mundane looking terrain might look peaceful and safe to a soldier who doesn’t know that there are landmines and booby-traps below the surface. Waterpolo looks like fun until you get into the water to get scratched, punched and kicked below the water line out of the referee’s view.

An iceberg is an awesome sight until the larger part of the berg busts a hole in your hull below the waterline. And that is exactly what the financial markets are about.

More than 90% of the time, your investment or trade gets compromised by events that are outside of Technicals and/or Fundamentals. The majority of these events are, more often than not, macroeconomic events via the news. Fundamentals don’t change overnight to hurt a short-term trade while macroeconomic events are not explained in your charts but the reactions are immediate and fatal to traders before they even know why.

Thus, I find it senseless and ineffective to spend so much time, money and effort to get an opinion on your positions based on something that is safe rather than identifying the dangers and planning contingencies for it. I will go further as to say that knowing the dangers can offer profits if one is trained to turn risk into opportunities.

Knowing the dangers also provides the trader with the one key factor with regard to their trade duration – Sustainability. While some events have a longer sustainable period, others are nothing more than knee jerk reactions while a lot of stuff is based on “pricing-in” moves before they happen.

It’s like trading Forex without fully understanding Monetary Policy or monetary value. And it’s crazy to think that it’s possible to trade two economies in one currency pair without fully knowing the economic status of those countries or the effect their monetary policies have on the currency.

Most novice Forex traders have no regard for or understanding of the economies’ business models and purely depend on a couple of technical indicators which are nothing more than algorithms based on mathematical permutations to make their trades. Nowhere in those indicators will you find important information as to the macroeconomic nature of the currency’s behaviour to know whether the trend is sustainable or irrational.

It would be a lie to say that successful professional Forex traders don’t use such algorithmic systems. They do. But they don’t purely depend on it. They would have a handle on the macroeconomic background of each economy they are trading to better gauge if the trading signals are sustainable or not.

It is very ignorant to say that such in-depth research and analyses is not important regardless of the style of trading. Gurus will tell you that it’s not important so that it’s easier to sell their ideas to you. But you should not be that naive. It is the responsibility of the trader to know these things if defence is your main priority. Remember that we talked about not losing money in the previous chapter?

QUESTION: So what’s real and what really works?

ANSWER: The answer is definitely not in your Technicals and Fundamentals.

Over the last twenty years, the ever-increasing dependency on technology has led us to believe that finding that holy grail to trading and investing can be possible with technical indicators. The quick advancements in technology is just too mind-boggling to fathom and much too complex for us plebs to understand. So we will just believe anything an “expert” tells us and take it in hook, line and sinker.

Let’s not forget lessons from the past when in another day in time, someone thought that the discovery of the Simple Moving Averages and the Bollinger Bands were the holy grail to trading and investing. Or that Candlestick Analysis goes back more than 480 years to a time when Japan was still in a warring state and yet today, almost half a millennia later, there are people who still believe that there is a secret holy grail to Candlestick Analysis.

Once again, the media and gurus have left a lasting impression that trading is all about technical indicators and algorithms. This is because it is tangible, visible and easy to understand. Thus, it sells well. Don’t forget that the more often we see it and hear it, we eventually believe it as fact.

But it never works as efficiently or accurately as it was sold. Most of all, it lacks consistency. So the novice goes hunting for the next best indicator or technical trick to see if the results improve. The hunt never ends.

But the dependency on technology doesn’t end there. And neither do the on-going tales of ignorance and gullibility.

FACT: People wants to be rich like Buffet but no one wants to know about Buffet’s patient style of consistent annual income – they only want the wind fall.

A couple of obvious observation I’ve made is that you don’t see floor traders running all around the floor during trading hours seeking out the best trade for today. Neither do you see investors like Buffet and Icahn asking each other for tips. And you certainly won’t see Soros or Paulson watching what other traders trade to know what “the next best trade” will be.

Yet that’s what you get with novice and amateur Online Traders and Investors. The use of screeners is about looking for the “best trade” to get that one big winner or winners. Such traders hardly know anything about the security that the screener throws up except for its technicals and fundamentals. They will trade it (without knowing why or if it will move) simply because the technical indicators say so.

Amateur investors who rely on tips are no better – they’ll buy anything as long as somebody credible says it’s a good buy. And it is unthinkable that people actually pay to know what the “masters” are buying so that they can do the same … after the fact!

OBSERVATION: I don’t know any famously successful person that followed someone else’s idea instead of blazing their own original or innovative trail to make it succeed.

In all the trading cases mentioned above, the intention to trade is sorely missing a reason or a catalyst that will move the price. In all case scenarios, the price would have already made its move by the time these amateurs take action. So the end result is a “hope and see how” strategy that often ends in no joy or worse, losses.

At best, they get lucky but when the luck runs out, they are not in the know because they were not aware of the position’s sustainability or lack thereof. Thus, profits turn quickly into losses.

For the short-term Trader, that trade is now a long term investment. The problem with that is that the Trader in those conditions usually doesn’t have holding power, either financially or psychologically.

All because of an over-dependency on easy-to-use technical tools, others’ opinions and a general lack of not knowing what they’re doing.

THOUGHT: If it really were that easy as taking tips, reading a book, using a screener or depending on technical indicators, wouldn’t we have plenty of success stories about it?

2nd THOUGHT: If the tipster were really that good, wouldn’t he be one of the best stock analysts in the world? If that book was truly that great, don’t you think it’ll cost more than $19.90 at the book shop or at least be sold out? If the screener or software or technical indicator was that effective, do you really think you could afford the costs to use it? Let alone use it for free?

Most novices I’ve met operate on what I term as Taxi Driver Knowledge; They know a little bit of this and a little bit of that but can talk a lot about it like they know everything about it.

Such traders and investors operate on the same sort of mindset. They think they know enough by reading a book or two and getting free stuff off the internet and public talks. Some others are just happy to pay to learn one simple trick from a keyboard warrior guru.

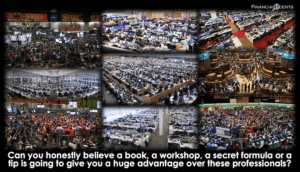

Let’s not forget who’s on the other side;

“… the pros are people who spent years in the best universities to learn this stuff and more years in mentorship in the greatest financial institutions, taught by old and grey veterans who know every dirty trick in the book.”

Now that’s a scary visual above, isn’t it? An in-your-face reality check and a truly humbling realisation.

Knowing that the pros took years and decades to hone their skills, sharpen their knowledge and pick up every manipulative trick in the business, do you think you have what it takes to go up against them with the Taxi Driver Knowledge you picked up from books, the internet, an unknown tipster and even some keyboard warrior guru?

At least the Taxi Driver gets you from point A to point B. I can’t say you’ll get anywhere with such limited knowledge of the financial battlefield.

QUESTION: Would you dare to do what you do at home, with your Taxi Driver Knowledge, if you were on the trading floor with all these pros looking at you and judging your every move? It’s been nice living in denial, hasn’t it?

We all want it easy. We don’t want to put in too much effort or time. And we certainly don’t want to wait too long for it. In fact, we live in an age of Instant Gratification from Minimum Effort for Maximum Gains.

On the planet on which I live, I’ve never met a truly successful person who;

- Didn’t bother learning everything about his craft

- Didn’t have a mentor or teacher or role model

- Didn’t take risks

- Didn’t work his ass off

- Didn’t fail several times

- Didn’t have patience

- Didn’t have endurance

- Didn’t have something to sell

- Didn’t make lots of sacrifices

- Didn’t continue doing all of the above even after becoming successful

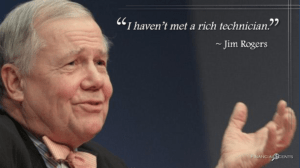

I’ve haven’t met a successful trader who isn’t working as hard as, if not harder than I am. And I’ve certainly never met a successful Technician.

In concluding Part 2 of The Obvious Lie, let me just say that I spend a lot of time reading, information gathering and data collecting in order to analyse my next move if the risk factors are not against me. I take a lot of effort in identifying risk that I can turn into opportunities but I don’t scan or screen for them.

My side of the half-truth is that I do have losses but they are controlled, planned and infrequent losses because of proper risk management.

Being a Global Macro Trader or Macrotrader allows me to know where to look and what to look for and when to do what I have to do. Most significantly, Macrotrading gives me the “Why“ or the reason to trade.

The “Why” – or in my case, The Five “Whys” – play an integral part in leading my analyses, answering questions and knowing where to start looking and researching. That’s why it is all about information, data and news.

Then there’s the misconception about Trading The News. (FYI, that’s not what Macrotrading is about.)

And that’s the topic for Part 3. (< Click to go there)

Have a great weekend!!

Copyright© 2019 FinancialScents Pte Ltd

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

PATTERN TRADER™ TUTORIAL

With 14 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most sought-after boutique-styled class that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

The small class environment and tutorial-styled approach gives the Tutorial a conducive environment that allows for close communication and interaction between the mentor and the participants.

The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

REGISTER FOR THE

INTRODUCTORY WORKSHOP NOW!

This is what graduates have to say …

“I will highly recommend this course and its Specialist Programs to anyone who wants venture into online trading. Conrad is so knowledgeable and no other courses have such massive contents, such as the Macros, Money-flow, Seasonality, Risk management, Fundamental and Technical Analysis, entry setup, etc etc.

This is really a Holistic Financial Education which applies to our daily-life both online and offline. I want to highlight the support provided by Conrad himself personally. “

“He will personally answer any and all queries or problems that we students faced. Personally, I have attended some other courses taught by other gurus, but really, there are none like Conrad.”

~ Desmond Lee

~~~~~~~~~~~~~~~~~~~~~~~~~~~

“Conrad has a way of teaching that makes it fun and easy to understand. Through his passionate and interactive teaching style, he has successfully set up a very conducive learning environment.

The course is very comprehensive as it covers everything from the introduction to the stock market, to macroeconomics, fundamental analysis, right down to the individual stock and options trading strategies.

Not only that! He also covers psychological and financial management which is always taken for granted. A community platform is also created for all the students to post questions and share their learning journey.”

~ Ting See Hung

~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial.

Download our promo slides here:

The Pattern Trader™ Tutorial 2019

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Write to conrad@finscents.com for queries and further information