Trading and getting no joy? You should read this … and get real. But be sure to read Part One and Part Two first.

In this final instalment of The Obvious Lie, we’re going to get a greater understanding of what it means to think, analyse and work as a Global Macro Trader or Macrotrader.

Before we go there, there’s a huge misconception about what Global Macro Trading is all about. It is NOT about Trading The News.

Imagine going on a romantic date and finding out that one of the four restaurants you were considering is having a huge bar-fight! You’re so intrigued and excited about the bar-fight that you decide to have your romantic dinner right in the middle of that restaurant as bottles and bar stools fly about. It’s only when one of those flying bottles hit you or your date in the head that you realise it was a bad idea to dine there. But you’ve paid a painful price for that lesson and you still have to pay the bill for your dinner. Plus tax. Should have considered the three other peaceful and uneventful restaurants instead.

That’s trading the news. It’s amazing how many people actually do that.

What’s more amazing are the people who gamble on the news by taking a trade before the news release. This is akin to dining at a restaurant that you know is famous for drunken bar-fights between two gangs who are sworn enemies who go there just to look for trouble every night.

In life, we take pains to avoid trouble or getting into trouble. But when we’re in the market, sanity and common sense go out the door and we look for the first sign of trouble thinking there’s profit to be made there.

I have no idea where this habit came from, who started it or why so many people still do it. But it is obviously being told or being sold as a way to trade for quick profits as evidenced in the massive (and unsustainable) volume spikes every time such events occur.

QUESTION: Ever wondered how people traded the news in the past when there was no radio, television, or internet?

ANSWER: They didn’t. The Japanese used the Sakata Method to trade a Secondary Move because 400 years ago, news travelled only as fast as the Denma (horse-riding messenger) could ride.

What I do in the markets are a reflection of how I live my life; I don’t go looking for trouble and prefer to avoid trouble.

Stocks that “fly under the radar” are my favourite. And contrary to common belief, there are many such stocks that are very liquid, mega or large capped and come with solid fundamentals. These are significant companies that many have not heard of and are seldom in the headlines for the wrong reasons.

The best parts of these “under the radar” stocks are that they often offer jaw-dropping momentum, are reliably cyclical and are almost always convergent with sentiment and expectations. Perfect for trading!

OBSERVATION: People usually shun such “unknown” stocks because they’ve never heard of them and assume they’re not as good as the popular picks.

Then you have those who go out of their way to find “unique” stocks that no one has heard of before. If they’re right, they’re going to be “special”. Most of the time, such picks are highly speculative (with poor fundamentals), ill liquid (because no one knows about them) and unsustainable (lacking the Five “Whys”). Majority of such gambles end in tragedy. Yet they persist against the odds.

FACT: I almost never read or hear about such success stories in abundance but the many horror stories following their disastrous results flood the media ever so often.

CURIOSITY: Sometimes, I wonder if such people trade for profit or do they trade for fame, face, pride or ego?

Trading the news is always going to end up with “buying the rumour and selling the fact”. That’s not Macro Trading.

Global Macro Trading about also NOT about being a fortune-teller.

Very often, during my public talks, attendees come up to ask me questions such as;

- “What do you think about this stock? “

- “Where do you think the market will go?”

- “Are we going to crash soon?”

- “Can you give me a tip?”

They may seem like honest, innocuous and innocent questions. But what these inquirers don’t realise is that only fortune-tellers can answer those questions, speculatively at that.

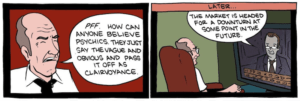

My only explanation for such mindsets is that the media and plenty of public speakers (gurus) make such predictions almost on a daily basis. To be fair, half those reports aren’t about predictions but about the possible outcome of their analyses or to manipulate the masses. They will use words or phrases like;

- “we think that … “,

- “it is our opinion that … ” or

- “if this analysis is correct …”

But when they do get it right, they will say things like;

- “we accurately mentioned that …”,

- “our expert opinion was spot on …” or

- “we called (insert prediction) correctly …”

This leads the masses to believe that traders are, or have to be, soothsayers or fortune tellers. They even want to know if we have some magic crystal ball or secret insider information that we hide from the public. Others believe that its some super technical indicator that we’re not sharing with the public.

Here’s the shocking truth; We really don’t know. And even if we thought we did, we’re never sure about its outcome.

As a Global Macro Trader, all I have is a risk management opinion derived from statistical data, money flow, cycles and repetitive patterns from historical performance to tell me if the risk is acceptable or not.

In spite of all that risk management, I still cannot be a fortune teller with certain accuracy. A lot more is needed in terms of trade management to know how to strategise the trade with the appropriate technique, system and qualifications. I need to know if the trade is sustainable by actively assessing various liquidity issues, macroeconomics, convergence-divergence, etc.

After all that , I need yet another set of analyses to know when, why and how I exit that trade. It might surprise many novice traders to know that the maintenance and exit plans are actually more important than the entry.

That’s right … it’s all about risk and liquidity.

Global Macro Trading is about understanding what really moves prices. It is about knowing the risks that can compromise the integrity of the position. It is about the liquidity that keeps the position sustainable.

Global Macro uses real market moving forces such as Market & Economic Cycles, Sector Rotation (Money Flow), Interest Rates, Earnings and Macroeconomic Data (News) – The Five “Whys” – circumstances that are sure to move prices more rationally than speculative fundamental projections and mathematical technical indications.

Naturally, there will be the irrational whipsaw reactions to such events before rationality prevails. Such short-term or quick gyrations are a combination of amateur knee jerks to the headline news, professional manipulation, scalpers jumping in and out for the quick return, robot algorithmic systems round-tripping orders and a mishmash of optimism and pessimism as the players sort out what’s rational or not.

After the dust settles, the price always finds a rational trend that is healthy on liquidity, convergent with current macroeconomic expectations and often in the sustainable direction of prevailing annual market conditions. Any anomaly to the current conditions could signal a sustainable change in the market’s direction and/or a turn in sentiment and expectations. The reason for which can always be explained using the Five “Whys”.

The duration of the sentiment or anomaly can also be determined by macroeconomics because the next possible change/reversal in sentiment is also due to the Five “Whys”.

Traders don’t buy-and-hold. Therefore there must be a time when it is most appropriate to exit the trade. Hold it too long and you subject yourself to gyrations that compromise your position. Get out too soon and you’ll regret not letting your profits run.

Thus the question; “When do I get out?”

The answer to that question is not a fundamental reason nor a technically calculated one nor a mathematical algorithm. “When” is a question of time. Thus the answer is a time-based answer. In almost every trading case, the question of “when” can be answered with a time-target.

Everyone knows how to plan price targets or calculate them. Stops are also a form of targets. But that is where the planning stops and the trade fails. The answer to “when do I get out” is never addressed and it becomes the most common reason for losses – getting out too late or holding the trade for too long after which comes the next most famous statement; “If only I knew …“. The truth is, you actually knew it. You simply didn’t plan for it.

If you knew that the market was going to become a bar-fight tomorrow because of Employment data or Monetary Policy Minutes, isn’t that a reason to exit with your profits before the bar-fight starts and hurts your bottom line? You could argue that you could get lucky and make more. But that’s where you and I differ – I don’t depend on luck – I work with facts. And the one fact I never deny is that taking profit guarantees that I don’t lose money.

Macroeconomic time targets are the simplest and most effective way to plan your exits for your short-term trades. Sector Rotation is a great way to know when to exit your long-term investments. There is nothing technical or fundamental about it and it really only uses common sense.

Then all else failing, I employ a technical time target to know when I am over-staying the trade or investment. Global Macro Time Targets combined with Technical Time Targets make a formidable exit plan that keeps me out of trouble before trouble comes calling.

Global Macro can also be applied to look for investing opportunities. Most amateur investors are only familiar with Value or Growth Investing. But few have ever delved into Sector Investing or Index Investing or Global Macro Investing.

We’re going to have a close, in-depth look at what REAL Investing is all about next week … not the bullshit stuff you read about or attend seminar workshops to learn (or did you attend those workshops to end up playing games instead?). Like the Obvious Lie about Online Trading, the world of investing has its own obvious lies. We’re going to wring them out.

This is why The Obvious Lie is that you can get rich quick in the financial markets. We know it isn’t true yet we don’t want to acknowledge it in our actions. We keep living in denial. We keep looking for that easy way, the quick route, that magic trick that can make it happen. We will believe any bullshit that sounds convincing even from gurus who were still in school during the last recession.

Trading is not as simple or as easy as many think it can be regardless of what they say, what you read and everything you hear. It never has been and I doubt it ever will be. Not as long as the market deals with manipulation, irrational human behaviour and criminal activities.

And that’s The Obvious Lie we’ve all been living with.

Have a great weekend!!

Copyright© 2019 FinancialScents Pte Ltd

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

PATTERN TRADER™ TUTORIAL

INTRODUCTORY SESSION

(SINGAPORE)

With 14 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most sought-after boutique-styled class that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

The small class environment and tutorial-styled approach gives the Tutorial a conducive environment that allows for close communication and interaction between the mentor and the participants.

The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

REGISTER FOR THE

INTRODUCTORY WORKSHOP NOW!

This is what graduates have to say …

“I will highly recommend this course and its Specialist Programs to anyone who wants venture into online trading. Conrad is so knowledgeable and no other courses have such massive contents, such as the Macros, Money-flow, Seasonality, Risk management, Fundamental and Technical Analysis, entry setup, etc etc.

This is really a Holistic Financial Education which applies to our daily-life both online and offline. I want to highlight the support provided by Conrad himself personally. “

“He will personally answer any and all queries or problems that we students faced. Personally, I have attended some other courses taught by other gurus, but really, there are none like Conrad.”

~ Desmond Lee

~~~~~~~~~~~~~~~~~~~~~~~~~~~

“Conrad has a way of teaching that makes it fun and easy to understand. Through his passionate and interactive teaching style, he has successfully set up a very conducive learning environment.

The course is very comprehensive as it covers everything from the introduction to the stock market, to macroeconomics, fundamental analysis, right down to the individual stock and options trading strategies.

Not only that! He also covers psychological and financial management which is always taken for granted. A community platform is also created for all the students to post questions and share their learning journey.”

~ Ting See Hung

~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial.

Download our promo slides here:

The Pattern Trader™ Tutorial 2019

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Write to conrad@finscents.com for queries and further information