It is the most common Investment style amongst amateur market players. However, it is not as safe and or as simple as it has been made out to be. Read on so that you don’t become a long-term victim of this most misunderstood style of investing.

It is often agreed that investing is “safer” than trading because prices tend to be irrational in the short term while prices tend to drive themselves to their proper valuations in the long term.

This was studied by two Nobel Prize winning professors, Professor Eugene Fama of University of Chicago Economics and Professor Robert Shiller of Yale Economics. Yet, in spite of all that research, no conclusion was drawn as to the fate of the short term traders who’s indicators and oscillators have, at best, let them down as Fama discovered.

Fama’s theory is that the market is “efficient” in that all factors bearing on price are almost immediately incorporated into the price of stocks. Thus, it is impossible for an investor to predict returns or to time the market because the factors that move the price of stocks are rationally incorporated into the price. However, this sort of thinking is flawed as it does not include valuations nor irrationality.

Fama, incidentally, has been credited with the buy-and-hold strategy that investors have come to know today.

Robert Shiller & Eugene Fama

On the other hand, Shiller believed that the market “prices-in” its moves thus making valuations a more reliable predictor of the market’s long-term direction. However, you cannot price-in over-valuations and under-valuations nor the irrational behaviour of the market and the manipulations that go on whether in the long term or short term.

From this we can derive one fact; the long term direction of the market is dependent on whether prices are over-valued or under-valued. The ensuing direction will correct prices to its proper value and in so doing, correct the market.

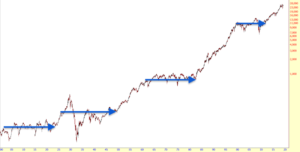

This has been the case on many occasions in history;

- In 1929, 2000 and 2007, prices were way over-valued in what has become the three biggest stock market bubbles in the last century. What happened next were the most spectacular crashes in stock market history.

- In 1982, 2003 and 2009, prices were way under-valued and that led to three of the most amazing rallies in the last fifty years.

In my opinion, the market is cyclical in the short term and drives upward in the long term because long-term investors only know one direction – up – when valuations are down. A plain and simple theory that is not going to win me any Nobel Prize. Then again, theory is theory and an opinion is only good for as long as the theory remains intact.

One common opinion is that if you buy and hold anything for five to ten years or more, it will be profitable.

Over the last 120 years, there have been no less than four occasions when holding anything for 5, 10, 15 and even 20 years would not have yielded the investor a gain. Only two occasions from 1945 to 1965 and 1985 to 2000 were it possible to hold an investment for 5, 10 and 15 years to get a gain. The current run started in 2009 and arguably ended on January 2018. That works out to roughly 44 or 45 years of long-term bull runs in the last 120 years. Thus, the market is not going to favour the bullish buy-and-hold long-term investor more than 62% of the time.

This, of course, refers to investors who seek price gains for massive ROIs. This does not take into account the fixed income investors who make from dividends. Maybe from this, you can see where the illusion of the buy-and-hold strategy gets its fame; Dividends, not price gains … at least not 62% of the time.

Once again, the media and manipulators have you eating right out of the palm of their hand. They’ll only show you the statistics to favour their bullshit while the obvious and more persistent dangers are kept from you.

Thus, the market is too dynamic for absolutes and you’d be a fool to think that you can find a one-size-fits-all method or strategy that can beat the market, whether in the short term or the long term.

And this is where Value Investing comes into the picture … and then how it became a toxic way to lose money for the misinformed and misguided.

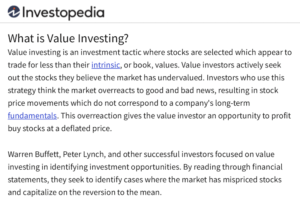

The Definition of Value Investing:

Value investing came from a concept by Columbia Business School

professors Benjamin Graham and David Dodd in 1934.

So in essence, Value Investing is a simple process of finding fundamentally sound stocks that have been irrationally beaten down below their valuation and buying them at a low on the premise that the stock will work its way back up to its true value in a matter of time. This value is known as an Intrinsic Value.

To calculate the Intrinsic Value of a stock, you can refer to this website to learn how this laborious and tedious process is achieved. The simpler way is to use this free online calculator or even this simplified one. (Disclaimer: I have nothing to do with these sites.) Value Investors will swear by this method and there are plenty of books and workshops that teach this. Then all you have to do is wait passively for the price to realise its Intrinsic Value in a matter of time.

Therein lie many problems. The premise is “in a matter of time” and during that unspecified time, a lot of things can happen like a recession, mergers & acquisitions, scandals, criminal activities, a crisis and even a flash crash. We won’t even delve into the rife practice of creative accounting that can mask a company’s EPS (earnings-per-share) or buy-backs that can rally the stock to insane highs sending PE (price-to-earnings) ratios through the roof while still maintaining a seemingly undervalued price.

It is ignorant to assume that holding the investment through such turmoil is a sound idea. In theory, it might work but the buy-and-hold strategy does not work for a lot of novices and amateurs for a myriad of reasons.

The Psychological Fallout is something many novices and amateurs don’t take into account when investing. As we’ve discussed in part one of Online Trading: The Obvious Lie, many players in the market are unaware of the vast differences between Trading and Investing and those who think they are investing have more of a trader’s mentality and greed that obviously doesn’t work in investing. This is especially so for those investing in price gains over time. This kind of mentality tends to work against this type of investor as major gyrations that put their profit-and-loss statements in the red, easily freaks them out. This is a sign of a risk-averse short-term trader rather than a passive investor.

Holding Power, or the lack thereof, is another problem. Those who invest for fixed income (dividends) tend to hold their positions better because their mindset is not about price gains. The reason for this is the basis for which they invest – to grow their money rather than make money. That tells you that they have the money to grow which is why they invest. Those who lack holding power usually don’t have that kind of money to be … for want of a better word … frivolous about their investments and thus, cannot afford to lose. In fact, they are in the investment to make money. Therefore it comes as no surprise that paper losses tend to make them jittery and irrational.

One problem with such investors is that they are not psychologically prepared for the endurance test that is investing. They have short-term attitudes that they assume can be applied to long-term strategies. The paper losses get to them so seriously that it affects their personal and professional lives. I have dealt with cases of medical depression amongst such individuals as a result of such circumstances.

Another problem is that they are not financially equipped with the affluence required to invest. Some cases I’ve dealt with were individuals who figured out how to be smarter than the system by borrowing money at 2.5% prime and investing in a possible 12% return in a year while locking in 4% on quarterly dividends. The intention is to make money. A technically and fundamentally sound plan … until the company cuts back on its dividends because revenues have fallen and the stock price can no longer maintain the trend as its Intrinsic Value has dropped. Now this investor is left with a losing position and an outstanding loan with an interest rate he can’t afford simply because he lacked liquidity and took on too much risk in the first place.

Did I mention the execution fees, margin calls, commissions, charges and spreads for foreign exchange? Never mind … you get the picture, I’m sure.

It is not that these people cannot be investors. It always boils down to a case of ignorance and/or naivety that stems from insufficient education or misdirected ideology. In other instances, it is gullibility in exclusively believing and absolutely trusting what they read or whom they learned it from.

To make matters more sinister, the concept behind true Value Investing has been lost or diluted as the media and gurus offer their own interpretation of what it means so that they can sell an idea, a seminar or a workshop.

The most misleading concept is that Value Investments are stocks that have become cheap or are currently cheap. This is a concept that attracts ignorant investors who are ill-liquid because cheap stocks are all they can afford.

An even worse idea is investing in penny stocks. This is an even worse idea than buying distressed U.S. properties in 2009.

Value Investing is not about buying cheap stocks. These penny stocks are cheap because they suck. Plain and simple. Argue and debate all you want but the fact remains – they suck because they are mostly ill-liquid and unnecessarily risky. If the company were any better, it wouldn’t be a penny stock.

Warren Buffet’s stocks are never cheap but they are undervalued. His purchases averaged between $45.00 per share to $110.00 per share including his top ten holdings; UAL, USG, CHTR, LUV, GS, DAL, MCO, BK, JPM, USB, AXP, KO, WFC, BAC and AAPL (as of 23 February 2019). At the time of his purchases, these companies were not cheap and the public didn’t understand or agree with a lot of his investments. But as it turns out, the stocks turned out to be some of the most profitable investments for Berkshire Hathaway.

He is able to spot investments that no one would consider; Burlington Northern Santa Fe Railroad (formerly listed as BNI) in 2008 at $100 per share or about $44 billion, including about $10 billion of its debt. It was the largest deal in Berkshire Hathaway’s history at that time. Many institutional experts thought that Buffett had lost his edge and even his mind with this deal.

However, he was fully aware that the future of the company’s earnings would vindicate his purchase even at 18 to 21 times earnings. Burlington Northern went on to make record earnings of $3.372 billion by 2012, which means that Buffett’s purchase price was actually 13 times earnings. That translates to an earnings yield of 7.7% in 2012 on its original purchase price for Berkshire Hathaway.

Amateurs dreaming of being like Buffett would never consider his purchases because they can barely afford it and it never seems like a good idea at the time. They often go for the obvious cheap purchases (that look like great, affordable ideas at that time) that the masses are flooding into but end up with no earnings performance and valuations that go nowhere.

From that example alone, it is obvious that there’s more than meets the eye when it comes to Buffett’s style of investing. It is not just about PE ratios, debt/equity ratios or intrinsic values and it certainly isn’t about cheap stocks.

Then there are the undercuts and various other pitfalls that make Value Investing unsafe. Rather than mention them all, let’s just look at the one that always undercuts the investor who mistakes a cheap stock for a value investment; Mergers & Acquisitions

We can never know the exact reasons for an M&A but it generally drills down to two possibilities; expand market reach and/or eliminate competition. Occasionally, an M&A is to bail out an ailing company with the intention of taking it over. In such situations, the acquiring company is going to bargain down the price of the purchase. Almost always, the agreed price will be lower than the last traded board price.

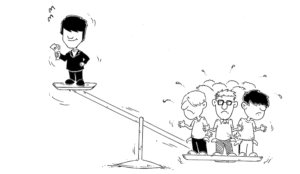

Consider this; If a novice or amateur can find a good value investment opportunity, don’t you think the big boys, the fund managers and even Warren Buffet himself won’t already know about it?

Given their massive advantage of leverage against the amateur’s tiny budget, the amateur who buys that stock online at board price won’t stand a chance of making any money on that stock against the likes of the big boys who are surely going to get the stock at a price cut later.

This is a situation that played out countless times and caught many an amateur out when the market bottomed in 2009. Stocks were looking cheap and discounted after the sub-prime crash so the masses scooped them up hoping to become the next Buffett.

What happened next was a tragedy that is rarely talked about – the big banks like JP Morgan acquired companies like Countrywide Financial and Merrill Lynch at significantly lower prices than the bid/ask price that was listed online. The acquired stocks, thereafter, never traded higher than their acquired price and were soon taken off the main board, leaving the amateur online value investor with a loss and no hope.

What if I told you that there are safer, simpler and more affordable ways to invest that you’ve never considered because you probably never heard of them? The media seldom mentions it, there is almost nothing about them on the internet and hardly anyone teaches it. Why? Because it isn’t glamorous, is not sensational nor news worthy and is not associated with famous names like Buffett or Icahn. Thus it won’t sell well and will remain unpopular.

But they are profitable.

Have you heard of Index Investing? If you haven’t, you’ve obviously missed out on reading my most viral article to date: Riding The Rate (The Fed Funds Rate, The Market & 2016). There’s also Momentum Investing and Growth Investing which in essence, has nothing to do with Value Investing. Then there’s Sector Investing, made popular by Sam Stovall in the late 90s through his best-selling book by the same title.

All of the alternative investment techniques mentioned above have one thing in common – Global Macro. In other words, it is about timing using macroeconomics rather than depend on the possibility of a price gain without any catalyst except “in a matter of time”.

Think about that for a while – you can buy the best stocks at the worst time and you’re going to lose money for sure. Or you can buy ordinary stocks at the best time and you’re likely to be profitable. It can be argued that no one can time the market. But there’s also the argument that many Global Macro investors and traders have timed the markets more accurately when compared to any other form of analyses.

Fama and Shiller were spot on (of course they were … they are Nobel Prize recipients) in that prices do work their way back up. However, given the many variables in the market, it would be wiser to time your investment according to economic cycles to get the most out of your investment rather than depend purely on a number that’s based on manipulated fundamental calculations and conjectured projections.

We’ll discuss the other safer investment techniques in the weeks to come.

Happy Hunting!!

Copyright© 2020 FinancialScents Pte Ltd

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

• • • • •

After 14 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most exclusive and sought-after boutique-styled class that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

The small class environment and tutorial-styled approach gives the Tutorial a conducive environment that allows for close communication and interaction between the mentor and the participants.

The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

• • • • •

This is what graduates have to say …

“I was introduced to PTT 10 years ago but put off the pursuit to take up this program due to family & work commitments. It’s better late than never and I have never regretted one bit having attended the Tutorial with Batch 96. In retrospect, I realised that it was a waste not doing this sooner and missing out all the good windows of opportunities over the last decade.

The course fee may appear to be a premium but in my personal view, this program is almost as good as taking up a MBA program to prepare you for the real financial world. It arms you with a good understanding of Macro Economics, as to how the world really moves money. The program has great content, is well structured and delivered in a systematic way where the whole puzzle around trading and investing adds up by the end of the program after 2 intensive weekends.

The no holds barred, no BS delivery provides a rude reality check about what real trading is all about. The excellent support, guidance and mentorship offered readily by Conrad is what makes the program unique and different from many other programs in the market. No hard-selling tactics and no hidden agendas in the program that will turn you off.

There are very methodical steps, techniques and guidelines on how to make CONSISTENT wins. The focus is on consistency of results and not a “get-rich-fast-and-furious” approach. Definitely not for the impatient and disillusioned ones who are looking for the holy grail to “sure-win-trading” because there are none to be found here. This is one program that would fit well for all levels of traders whether you are experienced, a newbie or even an institutional trader.

A great program I would recommend for anyone who is serious about trading consistently.”

~ C.E. Chng

~~~~~~~~~~~~~~~~~~~~~~~~~~~

“I will highly recommend this course and its Specialist Programs to anyone who wants venture into online trading. Conrad is so knowledgeable and no other courses have such massive contents, such as the Macros, Money-flow, Seasonality, Risk management, Fundamental and Technical Analysis, entry setup, etc etc.

This is really a Holistic Financial Education which applies to our daily-life both online and offline. I want to highlight the support provided by Conrad himself personally. “

“He will personally answer any and all queries or problems that we students faced. Personally, I have attended some other courses taught by other gurus, but really, there are none like Conrad.”

~ Desmond Lee

~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial.

• • • • •

Download our promo slides here:

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Write to conrad@finscents.com for queries and further information