Why do people choose to buy the dream

rather than see the truth that’s right in front of them?

In the previous instalment, we discussed two of the four key points of Behavioural Finance:

- Mental Accounting; about position and sizing with regard to the reason for investing relative to risk.

- Herd Instinct; the decision making process from the influences of the masses which have no bearing on risk or reason.

In this last instalment, we’re going to look at;

- Benchmarking; allows the investor to make comparisons to get a quantitative reason for their choice of investment.

- Lastly, Pride/Ego; about the need to be right with no regard to profit and/or loss or accuracy in comparison to peer performances.

Let’s begin this final instalment with Benchmarking. Let’s use life as an example of how this can go so wrong. This is the science of setting a target or goal based on previous experiences or other people’s achievements. Often, such benchmarks are unrealistic without effort and sometimes unmeasurable such as happiness, abundance and success.

Most of the time, we set such targets because we read it from some self-improvement article or attended some empowerment workshop or seminar. Consider this, if it were really that easy, don’t you think that the millions of readers and the hundreds of thousands of seminar attendees would have become successful by now?

So the truth is that attaining any sort of success or progress is not as simple as setting goals alone.

The majority of such readers and attendees tend to only hear what they want to hear and do only what they know how to do. They are mostly afraid to venture beyond their comfort zones.

Any such progress or success only comes with effort, perseverance and even some failure along the way. The fear of failure prevents such people from venturing out of their comfort zones. I find that kind of mentality irrational and foolish.

Thus they create benchmarks by making comparisons to their peers, to their past experiences and even benchmark themselves against celebrity influences. When they realise, after a long time, that these targets were unrealistic and/or unachievable, they often blame, find excuses or even live in denial that they ever set those targets in the first place.

So it is in trading and investing. However, in this business, many things get misconstrued, misunderstood and miscommunicated. The biggest misconception in benchmarking is that you can take on a profitable investment by emulating what famous investors did or are doing. Many simply follow what investment experts are buying … or have bought. However, they don’t buy the whole portfolio – they pick and choose what they can afford and expect it to perform according to some benchmark that was based on the performance of an entire portfolio. This is akin to a farmer expecting a huge harvest simply because he bought he bought a handful of good seeds.

From a personal POV, I am often faced with participants who benchmark other courses in comparison to what I do. The biggest mistake they make in this instance of benchmarking is that they compare the price on top of everything else. Quite regularly, the price matters most because of budget constraints. However, when you allow your current budget constraint to dictate your immediate wants, you’re making a bad investment from the get-go.

If you know what something is worth, that’s because you’ve done a lot of homework on it. You’ve researched it and compared it beyond its price. You’ve benchmarked it and found that there is no better choice. You know that’s what you need. However, you’re impatient to get it and your wallet doesn’t allow you to have it. So you make compromises and settle for second or even third choices to satisfy your immediate want.

Couldn’t you have been patient and saved up for it first? Instead, all your benchmarking homework flew out the window the moment you decided your wants were more important than your needs.

QUESTION 1: What’s more important to you … hear what you want or near the obvious truth?

-

- The trainer says all the right things to paint you a picture of the dream you want and sells you his course for $X,000.00 for a weekend experience of learning, motivation and games.

- The trainer tells you the truth that you don’t want to hear to paint you a picture of the nightmare you don’t need and sells you his course for $X,000.00 x 2 for two weekends of tough learning, hard work and reality checks.

QUESTION 2: What’s more important to you … qualifications or experience?

-

- The trainer has all the right qualifications and certificates, a couple of repeated testimonials, some success but no proven track record or sufficient relevant experience.

- The trainer was a school dropout and a failure in life but has turned his life around and has proven success on his own and for his students because of his massive relevant experience and actionable knowledge.

QUESTION 3: What’s more important to you … the trainer’s success or the students’ progress?

-

- The trainer who has to continually sell him/herself by painting a picture of lavish lifestyles and wealth to convince you that you can be next.

- The trainer who’s good reputation precedes all else and doesn’t have to sell much because of on going referrals from satisfied customers.

QUESTION 4: What’s more important to you … instant gratification or lasting support?

-

- The trainer who hasn’t been in the business for more than a handful of years who’s former students no longer get support because he’s gotten too successful and busy to have the time anymore … or like in most cases, is no longer in the business after three or four years for various reasons.

- The trainer who has proven to support his students even after 15 years and continues to upgrade them, stays in touch with them, answers all queries and gives support outside of the original course material.

QUESTION 5: What’s more important to you … idolising from a distance or in-your-face mentorship?

-

- The trainer who is a superstar that you gawk at in awe at but have absolutely no access to except for emails that probably won’t get answered personally.

- The trainer who takes the time to sit and have a coffee with you in spite of his busy schedule because you matter to him as do all those who paid him to be their mentor. Even after 15 years.

You’re not mistaken if you thought that the second trainer in all 5 scenarios are references to me. After all, I am using myself as a benchmark in these instances.

It’s no different when encountering any salesperson – they always tell you what you want to know and avoid revealing what really matters which obviously hurts their sales. They will hype up your wants to blind you from your needs.

This is why people end up buying things with money they don’t have. Salespeople know how to play on your ego, face and pride. They know how important it is to their client to be seen as making the right decisions and not losing out on a great opportunity.

They play on your need to be right and your fear of missing out.

In a previous article, “Traders Are NOT Fortune-Tellers”, we talked about pride and “the need to be right”.

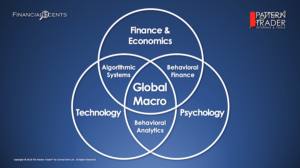

In trading as in life, there has to be a balance. It is never about what you prefer or want or what you have a bias towards. It is the sum of all relative things coming together in a balanced and cohesive manner.

I often get people telling me that they prefer technicals over fundamentals or that news is too noisy or that they are getting screwed by the market/broker, etc. The only explanation I can offer is that they haven’t adopted a complete and holistic approach to navigating the financial markets because of their preferences and prejudices.

Behavioural Finance is that complete and holistic solution that everyone, who is serious about their time in the markets, should adopt. There are no shortcuts, there are no magic pills and certainly no mathematical formulae that will beat the market, even some of the time, let alone all of the time.

But having the right mindset, the proper discipline and full knowledge of what you’re up against is definitely a step in the right direction.

FINAL QUESTION: What’s more important to you … making money or not losing money?

-

- A football team can score five goals at every match but concedes six while doing do. Although they’re scoring, they’re not winning.

- A football team can have the tightest defence and not concede any goals. They may not win the game but they certainly won’t lose. Plus they might score that odd winning goal too.

I am sure you know what that implies!

Have a great weekend!!

Copyright© 2021 FinancialScents Pte Ltd

• • • • •

After 15 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most exclusive and sought-after boutique-styled class that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

The small class environment and tutorial-styled approach gives the Tutorial a conducive environment that allows for close communication and interaction between the mentor and the participants.

The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

Join our next Pattern Trader™ Online Tutorial in March 2021.

INQUIRE NOW!

This is what past graduates have to say …

“I first attended the Pattern Trader Tutorial back in mid-2018. It has been one of the most value-for-money courses I’ve ever attended. Relative to other courses, the Pattern Trader provides everything in detail, from Macroeconomics to Central Banking to Fibonacci, fundamentals and technicals and trading strategy … all of it are included.

I was very pleased with the content as well as the post-tutorial support provided. We have a very active Facebook Group where the community shares news, content and discuss certain topics.

I was very pleased with the content as well as the post-tutorial support provided. We have a very active Facebook Group where the community shares news, content and discuss certain topics.

I chose to take a re-sit (in 2020) as I wanted to strengthen my understanding previously. As mentioned earlier, with the amount of content provided in such a short period, it is not easy to absorb everything completely in one sitting.

The re-sit allowed me to recap and review my previous understanding and rectify and gaps between then and now.

As this was done as an online workshop, I was happy that there was the option to re-watch the workshop at a later day (available only for a limited time before it was deleted). This function allowed me to replay the videos over and over again in order to grasp the many points made by Conrad.

There’s also new content, in additional to those that were taught back in 2018. This shows that Conrad and his team are continuously updating the content to keep it relevant and current to all his students.

I am glad to have taken the course and now I am looking forward for the Futures’ resit!”

~ Kee Joo Yee, K.L. Malaysia

~~~~~~~~~~~~~~~~~~~~~~~~~~~

“1 year after attending the Pattern Trader™ Tutorial, going through it again for a second time (re-sit) is still as interesting as ever because of Conrad’s continuous effort to keep improving and enhancing the content. The lessons just get better because of his passion in teaching us, his selfless contribution and willingness to share his financial knowledge .

“1 year after attending the Pattern Trader™ Tutorial, going through it again for a second time (re-sit) is still as interesting as ever because of Conrad’s continuous effort to keep improving and enhancing the content. The lessons just get better because of his passion in teaching us, his selfless contribution and willingness to share his financial knowledge .

Words alone can’t express how grateful am I was to be able to finally meet you and to attend your program. It really was an experience of a lifetime. It’s just like every Kungfu practitioners’ dream to learn from Bruce Lee / Ip Man. So much time and money was wasted attending other workshops over the past few years to learn that what I’ve learnt was not that I wanted to learn. I would say very few will ever come close to matching Conrad’s knowledge and experience.

A note to those who have not attended Pattern Trader™ Tutorial (PTT) before; This is definitely the right place for you. Search no more. This will be your last workshop. The proof is in the pudding! Do not miss the opportunity while Conrad is still teaching and sharing. The day he decides to stop teaching will be the biggest regret of a lifetime for those who wish to learn more about trading & the financial markets. Its true long term value is something money can’t buy!“

~ Rudy Lee, K.L. Malaysia

~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial.