Friday 22 September 2023 AMC

Stocks fail to preserve rebound effort

Today’s trade started on a upbeat note with the major indices all showing modest gains following this week’s sell-off. The early positive bias was due in part to a buy-the-dip mentality, which was supported by the price action in the Treasury market.

The market started to decline coming out of the New York lunch hour. Downside moves were interrupted by a brief rebound effort, but the major indices ultimately settled near their lows of the day. The deterioration was attributed to San Francisco Fed President Daly (a 2024 FOMC voter), who reportedly echoed the new party line that the Fed may have some more tightening to do. Ms. Daly’s comments followed similar remarks from Boston Fed President Collins (not an FOMC voter this year or 2024) and Fed Governor Bowman (FOMC voter).

Technical factors may have played a bigger role in the afternoon slide after the S&P 500 was unable to clear initial resistance at 4,361, reaching a high of 4,357 today.

Nine of the 11 S&P 500 sectors logged a decline. The consumer discretionary (-0.9%) and financials (-0.7%) sectors saw the steepest losses while the energy (+0.2%) and information technology (+0.3%) sectors outperformed. The latter was boosted by gains in Apple (AAPL) and NVIDIA (NVDA), which were also a source of support for the major indices.

The UAW confirmed reports that progress has been made on labor talks with Ford (F), but indicated that Stellantis (STLA) and General Motors (GM) are going to need “serious pushing.” Consequently, the UAW extended its strike to all GM and STLA parts and distribution centers beginning at noon ET.

Separately, the Bank of Japan made no changes to its policy stance, as expected.

Today’s economic calendar featured the preliminary September S&P Global US Manufacturing PMI, which improved from August (actual 48.9; prior 47.9), but was still indicative of contraction (i.e. below-50 reading). The S&P Global US Services PMI, meanwhile, still reflected expansion, but fell to 50.2 in the preliminary September reading from 50.5 in August.

Looking ahead, there is no U.S. economic data of note on Monday.

- Nasdaq Composite: +26.2% YTD

- S&P 500: +12.5% YTD

- S&P Midcap 400: +2.7% YTD

- Dow Jones Industrial Average: +2.5% YTD

- Russell 2000: +0.9% YTD

All three major US stocks indexed finished in the negative territory on Friday, as the Dow Jones slid 110 points, while S&P 500 lost and the Nasdaq closed lower by 0.2% and 0.1%, respectively. On the week, the Dow Jones lost 1.7% lower, while the S&P 500 and the Nasdaq declined 2.8% and 3.6%, respectively.

- DOW closed lower at 33963 (-0.31%)

- NASDAQ closed lower at 13211 (-0.09%)

- S&P 500 closed lower at 4320 (-0.23%)

- Lower than average volume

- NYSE 877 mln vs avg. of 905 mln

- NASDAQ 4,324 mln vs avg. of 4,916 mln

- Advancing/declining volume

- NYSE 372 mln/498 mln

- NASDAQ 1,858 mln/2,437 mln

- Decliners led advancers

- NYSE 1,372/1,514

- NASDAQ 1,872/2,477

- Lower than average volume

U.S. Treasuries

The 2-yr note yield, which is more sensitive to changes in the fed funds rate, was at 5.11% and settled at 5.12%, down two basis points from yesterday. The 10-yr note yield fell five basis points to 4.44%.

-

Bond Yields after the close on Friday 22 September:

- 3-mth: -1 bp to 5.56%

- 2-yr: -2 bps to 5.10%

- 5-yr: -4 bps to 4.57%

- 10-yr: -5 bps to 4.44%

- 30-yr: -3 bps to 4.53%

The yield curve steepened its key inversions on Friday as long-term maturity yields fell more than short-term maturity yields.

The inverted 2-year/10-year yield spread widened to -66 bps from -63 bps the previous session.

- The current inversion of the 2/10 which began on Tuesday 5 July 2022 is now three-hundred and eight sessions old, making it the longest period of inversion in 42 years.

- The current inverted 2y/10y spread at -107 bps, printed on Wednesday 08 March 2023, surpassed the previous widest spread printed on Tuesday 07 March 2023 at -103 bps.

- One needs to go back all the way to October 1981 to see a steeper inversion than the current one.

The inverted 3-month/10-year yield spread widened to -112 bps from -108 bps the previous session.

- The inverted 3m/10y spread that began on 25 October, is now two hundred and twenty-nine sessions old, making it the longest inversion in 42 years.

- –189 bps printed on Thursday 01 June and Thursday 04 May is the widest inverted spread on the 3m/10y, surpassing the -188 bps printed on Wednesday 01 June and Wednesday 03 May 2023, making it the steepest inversion in 42 years.

- -189 bps surpasses all the previous inverted 3m/10y spreads over the past 50+ years.

The inverted 10-year/Federal Funds Rate spread narrowed to -84 bps on Thursday 21 September from -98 bps on Wednesday 20 September.

- The current 10y/FFR inversion which began on Tuesday 15 November 2022 is two hundred and thirteen sessions old.

- The -171 bps spread on Thursday 04 May 2023 surpasses the -153 bps spread printed on Wednesday 05 and Thursday 06 April 2023 as the widest of the current inversion in over 22 years.

- The current inversion has surpassed the previous two inversions;

- May 2019 to March 2020

- July 2006 to January 2008

- One needs to go back to 02 January 2001 for a deeper inversion when the 10-year/FFR was at -175 bps.

- By my estimation, the inverted 10y/FFR spread would have widened to -89 bps on Friday 22 September 2023.

![]()

The U.S. Dollar Index rose 0.2% to 105.61, gaining 0.3% for the week.

- Currencies Majors:

- EUR/USD: -0.1% to 1.0649

- GBP/USD: -0.4% to 1.2244

- USD/CNH: -0.2% to 7.2972

- USD/JPY: +0.6% to 148.38

Crude oil extended its bounce off a ten-day low, returning to little changed for the week.

- Crude Oil futures rose $0.72 (0.8%) to $90.27/barrel

- Nat Gas $0.03 rose (1.06%) to $2.87/MMBtu

- Gold settled today’s session up $5.90 (0.3%) at $1,945.70/oz

- Silver settled today’s session $0.12 higher (0.51%) at $23.82/oz

- Copper settled flat at $3.70/lb

• • • • •

(Economic Excerpts from Briefing.com)

US Private Sector Stagnates in September

The S&P Global US Composite PMI came in to 50.1 in September 2023, down fractionally from 50.2 in August, to signal a broad stagnation in activity across the private sector, a preliminary estimate showed. The PMI for the fourth successive month and indicated the weakest overall performance since February, as service sector growth eased to an eight-month low and manufacturing output continued to contract due to high interest rates and persistent inflationary pressure. Total inflows of new business declined the most since December 2022 and outstanding business dropped at the sharpest rate since May 2020, while the rate of job creation quickened to the fastest since May. On the price front, input cost inflation quickened to the sharpest since June and the rate of charge inflation was among the slowest in three years. Finally, business confidence dipped to a nine-month low.

US Services Activity Expands the Least in 8 Months

The S&P Global US Services PMI fell to 50.2 in September 2023 from 50.5 in August, below market expectations of 50.6, preliminary estimates showed. It was the slowest rise in business activity in the current eight-month sequence of growth. Service sector firms saw a solid decrease in new business, following pressure on customer purchasing power from high inflation and interest rate hikes. A renewed fall in service sector new export orders led to another marginal decrease in total foreign client demand. Meanwhile, the pace of increase in staffing numbers accelerated. Finally, service providers were at their least optimistic in 2023 so far as strain on disposable incomes worsened.

US Manufacturing PMI Tops Forecasts

The S&P Global US Manufacturing PMI increased to 48.9 in September of 2023 from 47.9 in August, beating forecasts of 48, preliminary estimates showed. The reading continued to point to another albeit smaller deterioration in the manufacturing performance, as contractions in output and new orders softened. Meanwhile, sufficient stocks of inputs and finished items, alongside still subdued demand, led firms to reduce their purchasing activity sharply again and firms continued to work through inventories in lieu of expanding their input buying, which contributed to a further improvement in supplier performance. At the same time, a reduced need to hold stock of finished goods led to the second-fastest drop in post-production inventories since November 2021. The pace of increase in staffing numbers accelerated and input price inflation quickened amid higher fuel expenses, while output prices rose only marginally.

Japan Holds Rates, Signals No Rush to Tighten Policy

The Bank of Japan (BoJ) maintained its key short-term interest rate at -0.1% and that of 10-year bond yields at around 0% in its September meeting by unanimous vote. The central bank also left unchanged an allowance band of 50bps set on either side of the yield target, as well as a cap of 1.0% adopted in July. The BoJ mentioned that it would patiently continue with monetary easing and respond to development in economic activity, the dynamics of prices, and financial conditions, amid extremely high uncertainties at home and abroad. By doing so, the board aims to achieve a price stability target of 2% in a sustainable manner, accompanied by wage increases. The committee reiterated it will take extra easing measures if needed while being aware of rising inflation expectations. In a recent interview with a local newspaper, Governor Kazuo Ueda hinted that an end to negative interest rates could come sooner than previously expected if supported by enough data on wage hikes.

Boston Fed President Susan Collins (not a voting FOMC member)

Further tightening not off the table, expects rates to stay higher for longer;

- Collins agrees with the policy guidance in the median SEP projections which show rates staying higher, and for longer, than previous projections had suggested; and further tightening is certainly not off the table.

- While there is some evidence this realignment is underway, especially in the labor market, economic activity continues to be above trend and it is too soon to be confident that inflation is on a sustainable trajectory back to target.

- Collins is a “realistic optimist” — realistic about the uncertainties, but optimistic that price stability can be restored with only a modest increase in the unemployment rate.

- While recent inflation readings have been encouraging, inflation remains too high.

Fed Governor Bowman (FOMC voter)

Says she expects it will be appropriate to raise rates again. Bowman speech

San Francisco Fed President Mary Daly

(not currently a FOMC voter, will be voter in 2024)

Says rates closer to our destination, need to go at a slower pace;

- Said holding rates steady to collect information to see if more is necessary.

- Need to go at a slower pace.

- Inflation is coming down, labor market is gradually adjusting.

- Not ready to declare victory.

- U.S. economy has a lot of momentum.

- Seeing signs demand is coming down in reaction to rate hikes.

- Unlikely we’ll be at 2% inflation in 2024, remains committed to bringing inflation down.

Minneapolis Fed President Neel Kashkari (voting FOMC member)

Comments at Economic Club of Minnesota; “overall consumer spending continues to exceed our expectations”. Fireside chat video

- Japan’s National CPI 3.2% yr/yr (last 3.3%) and National Core CPI 3.1% yr/yr (expected 3.0%; last 3.1%). Flash September Manufacturing PMI 48.6 (expected 49.9; last 49.6) and flash Services PMI 53.3 (last 54.3)

- Australia’s flash September Manufacturing PMI 48.2 (last 49.6) and flash Services PMI 50.5 (last 47.8)

- New Zealand’s Q3 Westpac Consumer Sentiment 80.2 (last 83.1). August trade deficit NZD2.29 bln (last deficit of NZD1.18 bln)

- Australia’s Manufacturing PMI remained in contraction for the seventh consecutive month in the flash reading for September.

- Japan’s Manufacturing PMI was in contractionary territory for the fourth month in a row.

- The Bank of Japan made no changes to its policy stance. However, Bank of America expects negative interest rate and yield curve control policies to be ended early next year.

- Chevron appears to be nearing a contract agreement with striking LNG workers. Central banks in Philippines and Indonesia made no changes to their policy rates.

Equity indices in the Asia-Pacific region ended the week on a mostly higher note. China rallied 1.6%, while Japan shed 0.5%. The Shanghai Composite found favor following reports that China will loosen controls for foreign investment. This also gave the Hang Seng a burst of over 2%. In Japan, the Nikkei softened after the BOJ left its policy status quo. Also, the CPI for August came in a tick hotter than expected at 3.1%.

- Japan’s Nikkei: -0.5%

- Hong Kong’s Hang Seng: +2.3%

- China’s Shanghai Composite: +1.6%

- India’s Sensex: -0.3%

- South Korea’s Kospi: -0.3%

- Australia’s ASX All Ordinaries: +0.1%

- Malaysia’s FKLCI: +0.1%

- Singapore’s STI: +0.1%

- Eurozone’s flash September Manufacturing PMI 43.4 (expected 44.0; last 43.5) and flash Services PMI 48.4 (expected 47.7; last 47.9)

- Germany’s flash September Manufacturing PMI 39.8 (expected 39.5; last 39.1) and flash Services PMI 49.8 (expected 47.2; last 47.3)

- U.K.’s flash September Manufacturing PMI 44.2 (expected 43.0; last 43.0) and flash Services PMI 47.2 (expected 49.2; last 49.5). September CBI Industrial Trends Orders -18 (expected -18; last -15). August Retail Sales 0.4% m/m (expected 0.5%; last -1.1%); -1.4% yr/yr (expected -1.2%; last -3.1%). August Core Retail Sales 0.6% m/m, as expected (last -1.4%); -1.4% yr/yr (expected -1.3%; last -3.3%)

- France’s flash September Manufacturing PMI 43.6 (expected 46.0; last 46.0) and flash Services PMI 43.9 (expected 46.0; last 46.0)

- Spain’s Q2 GDP 0.5% qtr/qtr (expected 0.4%; last 0.6%); 2.2% yr/yr (expected 1.8%; last 4.2%)

- Barclays lowered its terminal rate forecast for the Bank of England to 5.25% from 5.50%, expecting the BoE to remain at the peak rate until the middle of next year. Meanwhile, Citigroup sees only a 35% chance of another rate hike.

- Flash September Manufacturing and Services PMI readings from France showed an accelerating contraction, stoking fears about the strength of near-term growth.

Equity markets in Europe closed lower on Friday as the prospect of higher for longer interest rates emerged from a slew of central bank decisions this week. The pan-European Stoxx 600 index ended the session down 0.3%, taking its losses for the week to 1.57% – its worst performance since mid-August, according to LSEG data. Construction and material stocks dropped 0.9% Friday, while tech stocks added 0.77%.

- U.K.’s FTSE 100: +0.1%

- Germany’s DAX: -0.1%

- France’s CAC 40: -0.4%

- Italy’s FTSE MIB: -0.5%

- Spain’s IBEX 35: -0.5%

- STOXX Europe 600: -0.3%

Monday 25 September 2023.

- The final week of September is prone to swings and ends poorly.

- The final week of September is also the end of Q3 and is prone to Portfolio Restructuring by institutions.

The Stock Trader’s Almanac’s stats for the Benchmark Indices for Monday of Week 39 over a 21-year average are;

- Dow Jones (DJIA): Bearish 57.1%

- S&P 500 (SPX): Bearish 57.1%

- NASDAQ (COMP): Mildly Bearish 52.4%

![]()

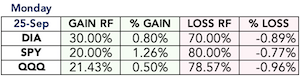

The Pattern Trader™ Tools Screener stats for the Benchmark Index ETFs for Monday of Week 39;

- SPDR DJIA ETF Trust (DIA – 19yr Avg): Very Bearish 70.00%

- SPDR S&P 500 ETF Trust (SPY – 19yr Avg): Ridiculously Bearish 80.00%

- Invesco QQQ Trust Series I (QQQ – 13yr Avg): Extremely Bearish 78.57%

Monday 25 September

- UK – CBI Realized Sales

- EU –

- German Import Prices m/m, Retail Sales m/m, Ifo Business Climate

- Belgian NBB Business Climate

- US –

- Nothing of note

Six For The Bears

Although the indices put some green in on Monday, the broader market internals said that the market was down for six straight days with the bears outpacing the bulls by more than 1.6-to-1 on any of the days, across the board.

Buying-the-dip activity was rife in the first half of Friday as the market attempted to finish the week on a positive note. Nine of the 11 S&P 500 sectors had been in positive territory before lunch led by the usual mega-cap tech stocks on no news or data. Then it all fell apart in the afternoon session, led down by those same mega-cap tech stocks and ending any dip-buying optimism.

That wraps up the first of the two most bearish weeks of the year. Next week, I reckon things will get serious.

Copyright© 2023 FinancialScents Pte Ltd

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

After 17 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most exclusive and sought-after boutique-styled mentorship that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

Enriching, Fulfilling, Life Changing

The personal mentorship and tutorial-styled approach delivers a conducive environment that allows for close communication and interaction between the mentor and the participant. The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial

Download our promo slides here: The Pattern Trader™ Tutorial