Monday 25 September 2023 AMC

Rates jump, but stocks manage modest gains

The major indices registered modest gains on Monday, but the complexion of things beneath the index surface showed an otherwise mixed market on a day when long-term rates continued to rise. The major indices nonetheless closed near their highs for the session.

The 10-yr note yield jumped eleven basis points to 4.55%, which is its highest level in nearly 16 years. Equities took that move in stride, though, after an initial bout of selling. The 2-yr note yield dropped one basis point to 5.09%.

Stocks moved somewhat lower at the open, pressured by the jump in rates and carryover downside momentum after last week’s losses. Things turned around quickly, though, and the major indices bounced off their lows, helped by a reversal in the mega cap stocks. The index bounce also coincided with the S&P 500 slipping below an initial support level at 4,305, which attracted some overdue buying interest amid a sense that stocks were short term oversold.

The market-cap weighted S&P 500 rose 0.4% and Vanguard Mega Cap Growth ETF (MGK) rose 0.5%. With today’s gains, however, the S&P 500, Nasdaq, and Russell 2000 are still down 3.8%, 5.4%, and 6.1%, respectively, for the month.

Eight of the 11 S&P 500 sectors closed in the green. The energy sector (+1.3%) saw the largest gain by a decent margin while the consumer staples sector (-0.4%) fell to the bottom of the pack.

Decliners led advancers by a roughly 11-to-10 margin at both the NYSE and the Nasdaq. Volume was on the lighter side today as a number of participants were out in observance of Yom Kippur.

In other news, Chicago Fed President Goolsbee (FOMC voter) was the latest Fed official to say he believes that the Fed has more to do to bring inflation back down to the target level.

There was no U.S. economic data of note today.

- Nasdaq Composite: +26.8% YTD

- S&P 500: +13.0% YTD

- S&P Midcap 400: +3.3% YTD

- Dow Jones Industrial Average: +2.6% YTD

- Russell 2000: +1.3% YTD

US stocks finished choppy session on Monday, as investors eyed economic data and Federal Reserve policymakers’ remarks later in the week for clarity on the path for interest rates. The Dow Jones closed more than 40 points higher, while the S&P 500 and the Nasdaq held on gains adding over 0.2% each.

- DOW closed higher at 34006 (+0.13%)

- NASDAQ closed higher at 13271 (+0.45%)

- S&P 500 closed higher at 4337 (+0.40%)

- Lower than average volume

- NYSE 798 mln vs avg. of 906 mln

- NASDAQ 4,118 mln vs avg. of 4,899 mln

- Advancing/declining volume

- NYSE 440 mln/352 mln

- NASDAQ 2,452 mln/1,628 mln

- Decliners led advancers

- NYSE 1,394/1,507

- NASDAQ 2,024/2,255

- Lower than average volume

Monday 25 September 2023 After-hours Action

Three hours into the close on Monday night, the index futures were flat and fractionally to the upside, ahead of Tuesday’s session which is filled with housing data.

Longer Tenors Face Continued Pressure

Longer-dated Treasuries began the week on a sharply lower note while the 2-yr note ended little changed, continuing last week’s outperformance leading into tomorrow’s $48 bln Treasury auction. The tone for the day was set early as Treasuries fell out of the gate after a night that saw selling in the futures market alongside weakness in other sovereign debt. The selling sent Germany’s 10-yr yield (2.80%) to a level not seen since 2011 while the 10-yr Treasury yield overtook last week’s high, returning to its highest level in nearly 16 years. The 30-yr bond lost two points with its yield rising toward its high from 2011 (4.79%). Longer tenors underperformed from the start, and they led the market lower in the afternoon action while shorter tenors finished a bit closer to their opening levels. The market did not receive any U.S. data today, but there was some focus on labor disputes as United Auto Workers reportedly made some progress in talks with Ford (F) while Hollywood studios reached a deal with striking writers.

-

Bond Yields after the close on Monday 25 September:

- 3-mth: +2 bps to 5.58%

- 2-yr: -1 bps to 5.09%

- 5-yr: +5 bps to 4.62%

- 10-yr: +11 bps to 4.55%

- 30-yr: +14 bps to 4.67%

The yield curve flattened the key inversions on Monday as long-term maturity yields rose in an upward pivot against the 2-year maturity yield.

The inverted 2-year/10-year yield spread narrowed to -54 bps from -66 bps the previous session.

- The current inversion of the 2/10 which began on Tuesday 5 July 2022 is now three-hundred and nine sessions old, making it the longest period of inversion in 42 years.

- The current inverted 2y/10y spread at -107 bps, printed on Wednesday 08 March 2023, surpassed the previous widest spread printed on Tuesday 07 March 2023 at -103 bps.

- One needs to go back all the way to October 1981 to see a steeper inversion than the current one.

The inverted 3-month/10-year yield spread narrowed to -103 bps from -112 bps the previous session.

- The inverted 3m/10y spread that began on 25 October, is now two hundred and thirty sessions old, making it the longest inversion in 42 years.

- –189 bps printed on Thursday 01 June and Thursday 04 May is the widest inverted spread on the 3m/10y, surpassing the -188 bps printed on Wednesday 01 June and Wednesday 03 May 2023, making it the steepest inversion in 42 years.

- -189 bps surpasses all the previous inverted 3m/10y spreads over the past 50+ years.

The inverted 10-year/Federal Funds Rate spread widened to -89 bps on Friday 22 September from -84 bps on Thursday 21 September.

- The current 10y/FFR inversion which began on Tuesday 15 November 2022 is two hundred and fourteen sessions old.

- The -171 bps spread on Thursday 04 May 2023 surpasses the -153 bps spread printed on Wednesday 05 and Thursday 06 April 2023 as the widest of the current inversion in over 22 years.

- The current inversion has surpassed the previous two inversions;

- May 2019 to March 2020

- July 2006 to January 2008

- One needs to go back to 02 January 2001 for a deeper inversion when the 10-year/FFR was at -175 bps.

- By my estimation, the inverted 10y/FFR spread would have narrowed to -78 bps on Monday 25 September 2023.

![]()

Dollar Firms Up on Hawkish Fed View

The U.S. Dollar Index rose 0.4% to 105.98, climbing past its March high to a level last seen at the end of November, as the Federal Reserve maintained a hawkish outlook on monetary policy due to persistently high inflation. The US central bank kept interest rates unchanged at its September policy meeting, but signaled another rate hike before the end of the year and fewer rate cuts than previously indicated next year. Data released on Friday also showed that US service sector growth eased to an eight-month low and manufacturing output continued to contract due to high borrowing costs. In recent sessions, the dollar strengthened the most against the Japanese yen as the Bank of Japan remained committed to ultra-easy monetary policy. The greenback also continued to appreciate against antipodean currencies as risk-off sentiment pervaded markets.

- Currencies Majors:

- EUR/USD: -0.5% to 1.0585

- GBP/USD: -0.3% to 1.2206

- USD/CNH: +0.3% to 7.3110

- USD/JPY: +0.3% to 148.80

Euro Depreciates to Over 6-Month Low

The Euro dropped below the $1.06 mark for the first time since mid-March, as there are indications that the European Central Bank might halt its interest rate hikes, given that concerns about economic slowdown outweigh inflation worries. Investors do not anticipate any further rate increases this year and are even considering a slight possibility of a rate cut by next June, with a rate cut being nearly fully priced in by July. ECB President Lagarde stated on Monday that policymakers believe the bank’s policy rates have reached levels that, if maintained for an extended period, would significantly contribute to achieving the inflation target. Additionally, ECB board member Villeroy de Galhau suggested that the ECB should avoid pushing the economy “until it breaks,” implying his preference for not raising rates further. Meanwhile, their colleague Schnabel cautioned that it’s too early to conclude that the eurozone’s battle with high inflation is over.

Oil Prices Steady as Market Outlook Mulled

Crude oil gave back Friday’s gains by settling below $90 per barrel on Monday as investors weighed tightening global supplies against demand concerns. Oil has rallied nearly 30% since the end of June as OPEC+ majors Saudi Arabia and Russia extended supply cuts through the end of the year, stoking fears of larger market deficits in the fourth quarter. Additionally, Russia recently issued a temporary ban on fuel exports to most countries in order to stabilize the domestic market. US oil production also continued to decline according to industry and official reports. Meanwhile, the oil rally stalled last week as the US Federal Reserve retained a hawkish stance at its September policy meeting, raising concerns about economic growth and energy demand. Demand uncertainties in China, the world’s top crude importer, also weighed on sentiment, though recent data pointed to economic stabilization.

- Crude Oil futures fell $0.65 (-0.72%) to $89.62/barrel

- Nat Gas $0.03 rose (1.08%) to $2.90/MMBtu

- Gold settled today’s session down $11.10 (0.57%) at $1,934.60/oz

- Silver settled today’s session $0.48 lower (2.02%) at $23.34/oz

- Copper settled $0.03 lower (0.86%) at $3.67/lb

Palm Oil Futures Hover Above MYR3,700

Malaysian palm oil futures were trading above MYR 3,700 per ton, trying to move away from their lowest level in three months of around MYR 3,670 notched last week, amid gains in rival oils and a softening ringgit. Meantime, a worsening drying trend may emerge in October for top producer Indonesia, according to Refinitiv Commodities Research. On cargo surveyor readings, exports of Malaysian palm oil products for Sept. 1-20 rose 2.4% from Aug. 1-20, Intertek Testing Services said last week. Independent inspection company AmSpec Agri Malaysia said exports during the same period rose 1.8%. Meantime, cargo surveyor data for Sept. 1-25 will be released later in the day. In India, palm oil imports in August rose about 3.9% from the previous month to a 9-month high of 1.13 million, as the country is approaching a festive season. Limiting the rise was inventory data that showed Malaysian palm oil jumped 22.5% mom at the end of August to a 7-month high of 2.12 million tons.

Baltic Exchange Dry Index At 4-Month High

The Baltic Exchange’s dry bulk sea freight index was up for the second straight session, rising about 1.3% to its highest since May 10th at 1,614 points, mainly boosted by the bigger size segment. The capesize index, which tracks vessels typically transporting 150,000-tonne cargoes such as iron ore and coal, advanced 3.1% to an over four-month high of 2,148 points; and the panamax index, which tracks ships that usually carry coal or grain cargoes of about 60,000 to 70,000 tonnes, remained unchanged from the prior session at 1,685 points. Among smaller vessels, the supramax index was flat at 1,354 points.

• • • • •

(Economic Excerpts from Briefing.com)

Chicago Fed Index Down in August

The Chicago Fed National Activity Index fell to -0.16 in August 2023 from a downwardly revised 0.07 in July, pointing to slower economic growth during the month. Production-related indicators contributed -0.02 (vs +0.12 in July); the contribution of the personal consumption and housing category moved down to -0.08 from +0.03 ; and the contribution of employment-related indicators was unchanged at -0.04. At the same time, the contribution of the sales, orders, and inventories category ticked up to -0.03 from -0.04. Meanwhile, the index’s three-month moving average, CFNAI-MA3, increased to -0.14 from -0.15. The CFNAI Diffusion Index, which is also a three-month moving average, moved down to -0.04 from -0.01.

Moody’s says it appears increasingly likely that US federal gov’t could enter partial shutdown by month’s end

Impact would likely be short-lived, underscore weakness of US institutional and governance strength relative to other Aaa-rated sovereigns.

- “It appears increasingly likely that the United States (Aaa stable) federal government could enter a partial shutdown by the end of this month (September is the last month of the fiscal year) if the pending annual appropriations bills that fund government agencies, or a continuing resolution (CR) that would temporarily fund government operations, are not passed by Congress.

- A shutdown would be credit negative for the US sovereign. While government debt service payments would not be impacted and a short-lived shutdown would be unlikely to disrupt the economy, it would underscore the weakness of US institutional and governance strength relative to other Aaa-rated sovereigns that we have highlighted in recent years. In particular, it would demonstrate the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability.”

Chicago Fed President Austan Goolsbee (FOMC voter)

Says Fed has more to do to bring inflation back down to target.

- Risk of inflation staying higher than where the Fed wanted is the bigger risk

- Employment side of mandate doing very well but have to do more on inflation

- External shocks have derailed Fed from achieving soft landing in the past

- Doesn’t think 2% inflation target will change; can’t change it if you haven’t reached it, which would defeat the whole purpose of having the target; Fed needs 100% commitment to get inflation back to 2%

- Possible that things could get worse in coming months/years based on what the Fed has already done

- Thinks the question will transform from “how much more will the Fed raise” to “how long will the Fed stay where it is”; believes we’re getting close to the latter

- Unemployment rate still roughly where it was when the inflation rate was twice the rate it is at now

- Singapore’s August CPI 0.9% m/m (last -0.2%); 4.0% yr/yr, as expected (last 4.1%). August Core CPI 3.4% yr/yr (expected 3.5%; last 3.8%)

- China’s troubled developer Evergrande returned to headlines, announcing that it cannot issue new debt and it is scrapping a planned $35 bln debt restructuring. In addition, one of the company’s subsidiaries is being investigated.

- Shares of Country Garden were pressured after bondholders said that they did not receive a payment that was due a week ago.

- A People’s Bank of China official said that additional easing of policy is unlikely.

- Australia may change its definition of full employment.

Equity indices in the Asia-Pacific region began the week on a mostly lower note. China gave up 1.8%, while Japan gained 0.9%. The Shanghai Composite came under pressure as concerns in the property market triggered pressure. Evergrande Group dropped over 20% after revealing it could not issue new debt. In Japan, the Nikkei’s four-day losing streak came to an end. Eisai outperformed the benchmark after regulators cleared the company’s Alzheimer’s drug.

- Japan’s Nikkei: +0.9%

- Hong Kong’s Hang Seng: -1.8%

- China’s Shanghai Composite: -0.5%

- India’s Sensex: +0.0%

- South Korea’s Kospi: -0.5%

- Australia’s ASX All Ordinaries: +0.1%

- Malaysia’s FKLCI: -0.5%

- Singapore’s STI: +0.3%

- Germany’s September ifo Business Climate Index 85.7 (expected 85.2; last 85.8). September Current Assessment 88.7 (expected 88.0; last 89.0) and Business Expectations 82.9, as expected (last 82.7)

- U.K.’s September CBI Distributive Trades Survey -14 (expected -33; last -44)

- Spain’s August PPI -10.0% yr/yr (last -8.6%)

- Spain’s PPI was down 10.0% yr/yr in August, contracting at a faster rate than what was seen at the height of coronavirus pandemic lockdowns.

- European Central Bank policymakers Villeroy de Galhau, De Cos, and Kazaks spoke in favor of pausing rate hikes at the October meeting.

- Italian banks will reportedly be exempt from paying the planned windfall tax if they increase their capital reserves.

- The Bank of England will delay the implementation of global banking reforms by another six months.

The German DAX lost 1% to 15,405 on Monday, the lowest close in six months led by an over 4% decline in Zalando shares. Also, the benchmark Stoxx 600 went down 0.6% to 450, the lowest in six weeks, dragged by travel and leisure stocks and household goods. This slide was driven by a surge in bond yields due to concerns about rising oil prices and their potential impact on inflation and the outlook for monetary policy. Meanwhile, ECB President Lagarde reiterated that policymakers believe the bank’s policy rates have reached levels that, if maintained for an extended period, would significantly contribute to achieving the inflation target. Also, French ECB official Francois Villeroy de Galhau said that interest rates are unlikely to rise significantly higher, with the current focus being on maintaining them until inflation is under control.

Equities in London sank 0.7% to close at 7,627 on Monday, extending the slight losses from the prior week, pressured by fresh concerns over contagion in the Chinese economy and the prolonged hawkish policy from central banks. Shares with exposure to the Chinese economy and US borrowing costs, especially industrial miners, were among the main laggards.

- U.K.’s FTSE 100: -0.8%

- Germany’s DAX: -0.9%

- France’s CAC 40: -0.9%

- Italy’s FTSE MIB: -0.7%

- Spain’s IBEX 35: -1.2%

- STOXX Europe 600: -0.6%

Tuesday 26 September 2023.

The Stock Trader’s Almanac’s stats for the Benchmark Indices for Tuesday of Week 39 over a 21-year average are;

- Dow Jones (DJIA): Bullish 57.1%

- S&P 500 (SPX): Mildly Bearish 52.4%

- NASDAQ (COMP): Mildly Bullish 52.4%

![]()

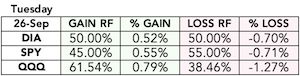

The Pattern Trader™ Tools Screener stats for the Benchmark Index ETFs for Tuesday of Week 39;

- SPDR DJIA ETF Trust (DIA – 19yr Avg): Flat-to-Bearish 50.00%

- SPDR S&P 500 ETF Trust (SPY – 19yr Avg): Bearish 55.00%

- Invesco QQQ Trust Series I (QQQ – 13yr Avg): Bullish 61.54%

Tuesday 26 September

- Japan – SPPI y/y, BOJ Core CPI y/y

- China – CB Leading Index m/m

- US –

- July FHFA Housing Price Index (prior 0.3%) at 9:00 ET

- July S&P Case-Shiller Home Price Index (prior -1.2%) at 9:00 ET

- August New Home Sales (prior 714,000) at 10:00 ET

- September Consumer Confidence (prior 106.1) at 10:00 ET

- $48 bln 2-yr Treasury note auction results at 13:00 ET

Technical Levels & Short Covering Kick In

The major indices were confronted with additional selling pressure right at the outset of the market open, although that pressure wasn’t as pronounced as last week despite yet another bump in market rates. Short-covering took over as soon as the benchmarks touched critical technical levels but failed to build on the momentum, especially amongst the mega-caps.

I’m expecting things to remain at a status quo on Tuesday unless the housing numbers spring a huge huge surprise. Volumes should stay low and uninspired until Wednesday afternoon’s FOMC decision.

Copyright© 2023 FinancialScents Pte Ltd

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

After 17 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most exclusive and sought-after boutique-styled mentorship that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

Enriching, Fulfilling, Life Changing

The personal mentorship and tutorial-styled approach delivers a conducive environment that allows for close communication and interaction between the mentor and the participant. The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial

Download our promo slides here: The Pattern Trader™ Tutorial