This three-part series explores something so important and

common in today’s financial markets for which not enough

has been written about when compared to the

unimportant stuff that flood the internet and bookstores.

Behavioural Finance is a very modern concept that studies the effects of human neuroscience and psychology with conventional economic-theory and how it influences people in their economic and/or financial decisions.

Generally, people take an academic approach to investing by studying and researching numbers and statistics for fundamental soundness and then technically by using charting for identifying risk and possibly, opportunities. After all that and in spite of all that academic approach, they ironically take an emotional stance when making a decision to pull the trigger, hold the position and are more emotional when considering an exit. In most cases, these emotions are irrational, often driven by fear and greed in spite of all the academic and logical approaches and preparations.

The concept of such behaviour was well documented by Nobel laureate Daniel Kahneman. In his study, he noted that the brain responses to monetary loss in the same part of the brain that reacts to body’s defensive functionality while the part of the brain that analyses logic and academia is in a different region altogether. This would account for why it is such a challenge for many inexperienced financiers to make sound and logical decisions when emotions are running high.

“Behavioural finance is the study of the influence of psychology on the behaviour of investors or financial practitioners and ultimately, its subsequent effect on the markets.”

Behavioural Finance encompasses many concepts that can be drilled down to four key points: mental accounting, herd instinct, benchmarking, and pride/ego.

- Mental Accounting is about position and sizing with regard to the reason for investing relative to risk.

- Herd Instinct is the decision making process from the influences of the masses which have no bearing on risk or reason.

- Benchmarking allows the investor to make comparisons to get a quantitative reason for their choice of investment.

- Lastly, Pride/Ego is about the need to be right with no regard to profit and/or loss or accuracy in comparison to peer performances.

Thus, logic and rationality is glaringly missing from the equation. It should not be surprising because the market is manipulated most of the time and divergent in its thinking some of the time, for example, when is good news bullish and when can good news be bearish?

The short answer is; Expectations.

Every player brings his or her own expectations into the market. Whether you call it a prediction, an analysis, a wild guess or even “anyhow tikam”, these expectations turn into reactions whether they were right or wrong. Some react faster (irrational short-term knee jerks) while some watch and wait (tolerant risk-takers) and others just hold on because they are either in shock that they were wrong or have not accepted that they can be wrong. Then you have the few steadfast ones that insist that “it will come back”.

Such varied reactions are proof that expectations play a huge part in how prices move irrationally in the short term and eventually become rational in the long term. The varied reactions also reveal the many kinds of systems in play in the market that bring on these different predictions, analyses and guesses. To make things more complicated, in the current age, we have a massive amount of technological additions to add to the already confusing fray.

Once upon a time, when our only access to the markets was via a licensed broker, when the only information you were privy to was via the radio, T.V. and newspaper, the markets were already confusing and difficult to read and make sense of.

All we had then was what we knew about finance, economics, mathematics and some basic technical analysis like Point & Figure Charting and Pivot Points. No ‘live’ charts existed and the only ‘live’ prices were available at the exchange exclusively. It wasn’t until the 1980s that we got ‘live’ prices on our T.V.s thanks to teletext. Even then, it was a pain to get our orders filled because you could never get a phone call through to your broker in a time without mobile communications or call-waiting facilities. God forbid you had to close a position urgently because you heard some bad news on the radio while you were in a taxi or driving in heavy traffic.

The market was a very exclusive place back then. Without a broker, you had no access. Thus, the brokers, in a sense, helped to keep the market sane and orderly to a certain extent by keeping the amateurs out or advising them against certain irrational behaviour.

Then computers and the internet came into the picture and made the game more complex and sophisticated. Now anyone with an internet connection and a laptop can buy and sell on a whim and fancy, making the market even more irrational and wilder than it has ever been in history. This is evident over the last 20 years when you look at the massive increase in volumes and volatility since before the internet and now.

S&P500 1997-2019

As the market evolved and embraced the new economy of online traders, the conventional thinking of Behavioural Finance also changed. What was purely a human thing once, has now added another dimension to its complexity – the world of technological influences including quants and automated algorithmic trading.

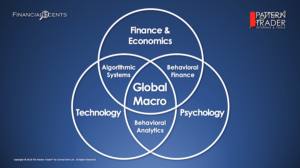

The picture just got bigger than merely Finance & Economics + Psychology to determine Behavioural Finance. The Technological spectrum has brought into play the added dimensions of Algorithmic Systems and Behavioural Analytics.

Automated or Robot-Trading systems have no regard for sentiment, emotions, valuations, demand-supply or fundamentals. These are exclusively technical and mathematical systems that generate automated trading triggers based on various algorithmic and/or mathematical settings and at times, reading key words from the latest news release.

DJIA on May 6, 2010

And they get it wrong too. It becomes a huge problem for the humans when the machines get it wrong because it has resulted in some record-breaking “Flash Crashes” that have unnecessarily lost humans a lot of money.

These days, it is common to have these multi-billion dollar machines “take over” the trading session. At Pattern Trader™, we call such sessions, “Algor Days” and avoid trading on such days. Their presence in the market is quite obvious if you know what to look for. It makes it so frustrating for the human trader. The systems totally ignore any and all human conditions to trigger millions of orders in very short timeframes and repeats the process throughout (as much as) one half of a trading session.

Besides raking in a f**kton of money for their owners, these systems don’t serve any other purpose in the market except to make the market more volatile and more manipulated.

On a personal note, that is not trading. In fact, the SEC has deemed many parts of such systems including the tactics of spoofing, layering and quote stuffing as criminal.

(Almost) gone are the days when trading and investing were about identifying opportunities for profit. Today, these systems hunt down such profit-hunters to profit from them. Thus, the “human neuroscience and psychology with conventional economic-theory” of conventional Behavioural Finance can’t be accurate anymore unless you include the technological factor.

Although the big picture just got more complex, there is a sweet spot that still exists right in the middle of the Venn diagram. And in my opinion, Global Macro fits perfectly in there to bind most, if not all the price moving factors. Whatever the expectations are, macroeconomics sets the price in motion and is often the brakes to which price action stops or the trigger that changes its direction. It is the rational catalyst that pushes prices in their rightful direction after the initial knee jerk reaction.

Conventional Behavioural Finance sits between Psychology and Finance/Economics where Global Macro fits in nicely to be the trigger of most rational price movements.

Then between Psychology and Technology, Behavioural Analytics become the result of Global Macro events that give you the repetitive price actions that form consistent patterns that are mostly cyclical behaviour and seasonal trends.

To complete the diagram, Technology with Finance/Economics give you Algorithmic Systems where the billion-dollar machines trigger irrational quick price actions as a result of Global Macro events.

From this, we’re able to breakdown the four key behavioural patterns amongst the players to determine how they resort to mental accounting, why they need to benchmark, when they become part of the herd and what makes them need to be right.

By understanding the reactions from the various expectations that derive from the different systems in play, we can then make sense of why the market does what it does immediately after news events, a few days after the event and in the longer term as a result of the event. And from each reaction you get opportunities to make a profit depending on your risk appetite.

Talking about risk appetite, the Venn diagram also helps you to determine your risk appetite by weighing how much you put into Fundamentals and Technicals (under Behavioural Finance) or Statistical Systems (Behavioural Analytics) or Automated/Black Box Systems (Algorithmic Systems).

For example;

- If you trade or invest based purely on Behavioural Analytics, you risk losing to the irrational Algorithmic Systems, which is rare and sometimes avoidable.

- If you only depend on Technical and Fundamental Analysis for your trading or investment decision, you run the risk of losing to macroeconomic events, demand and supply (Finance & Economics) and possibly being on the wrong side of the trade (Behavioural Analytics).

- If you choose to trade on Automated or Black Box Systems, you are always going to lose by being on the wrong side of the trade, by ignoring demand and supply, by not understanding why the market did what it did (Psychology) and by overlooking the simple fact that the automated system is purely mathematical and does not take into account the biggest price trigger of all, Global Macro.

You may rightly claim that I am prejudiced or biased toward Global Macro because I am a Macro Trader. But let’s be objective here and face the one fact no one can deny; It is always the news or some geopolitical event that shook the market and thus, compromised your position. It is also these events that generated your last winning trade. So in my biased opinion, it makes sense to have Global Macro as my pivot point to which my whole trading and investing world rotates around.

In the next two parts of Behavioural Finance For Beginners, we’re going to delve into the four key points and discuss how Global Macro can help calm the nerves, keep you focused on your objective and assist in understanding the market behaviour better.

Read the second part Behavioural Finance For Beginners- Part 2 here.

Have a great week ahead!!

Copyright© 2021 FinancialScents Pte Ltd

• • • • •

After 15 years of educating, mentoring and supporting hundreds of participants (annually) in the arts and sciences of Finance and Economics, the Pattern Trader™ Tutorial has evolved to become the most exclusive and sought-after boutique-styled class that caters to retail individuals, institutional professionals, businesses and families that are serious about their finances and their prospects as we move into the future.

The small class environment and tutorial-styled approach gives the Tutorial a conducive environment that allows for close communication and interaction between the mentor and the participants.

The hands-on style makes the Tutorial very practical for anyone who requires a start from the ground up. It is the perfect beginning for anyone who wishes to take that first step in improving their financial and economic literacy.

Join our next Pattern Trader™ Online Tutorial in March 2021.

INQUIRE NOW!

This is what past graduates have to say …

“This is unarguably one of the best courses I have ever attended.

The syllabus focuses on building your foundation so that you are well equipped to survive in this turbulent economy. It teaches you to be defensive in protecting your capital and managing your risk, which in my opinion, is crucial to successful trading.

On top of all that, Conrad goes the extra mile to ensure that his students do well in trading. This includes his own attendance to additional training programs to learn more and master his craft of trading and teaching.

He created an active community of like-minded traders who never hesitate to provide a helping hand should any of his students encounter hiccups during their trading journey.”

~ Eva Lam, PTTMY16, 2010, PTTORS2020.

~~~~~~~~~~~~~~~~~~~~~~~~~~~

“Having first attended the Tutorial back in 2016, and subsequently the Tutelage and Options programs, The course did give me a good start into finance and economics and how to navigate our own financial management on a daily basis.

Going back for subsequent re-sits was always welcomed. Whether you are new to this or that you have been with Conrad since 10 years ago, the support has constantly been present. Never have the re-sit students been ignored and forgotten.

Over the years, the syllabus has always improved. You always learn something new at each re-sit where you’ll gain a little more insight into the market and into your own mindset. Such is Conrad’s dedication and expertise that there isn’t any other teacher who can bring more to the table than he does.

My financial knowledge and management has definitely improved over the years and that has help with life as well as with work in the finance sector. All these have led to better investment decisions and results.

Thank you Conrad for all the knowledge and support shown over the years. Of all the investments, the tutorial has been the best investment by far.“

~ HC Ma, Singapore

~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you’re looking to make a huge difference in your financial life and get the most value for your education investment, there’s no better choice than the time-tested and well reputed Pattern Trader™ Tutorial.